The United States is approaching a financial tipping point. With national debt exceeding 124% of GDP and rising interest rates, the burden of servicing this debt has become increasingly unsustainable. As the cost of borrowing increases, so does the risk of economic instability. The U.S. government faces a dilemma: either allow inflation to erode the real value of debt or implement austerity measures that could stifle growth.

In times of fiscal uncertainty, inflation often becomes a tool for governments to reduce debt levels, but this has dire consequences for the average investor. Inflation erodes purchasing power, causing the value of traditional assets like stocks and bonds to plummet. One solution that remains constant through economic upheavals is physical gold.

Historically, gold has proven its resilience as a store of value, especially during periods of high inflation and economic instability. Gold’s intrinsic value, limited supply, and global acceptance make it a critical hedge against currency devaluation and economic shocks. Investors who allocate a portion of their portfolios to physical gold are not only protecting their wealth but also positioning themselves to capitalize on the potential long-term benefits of gold in an inflationary environment.

The U.S. Debt-to-GDP Crisis

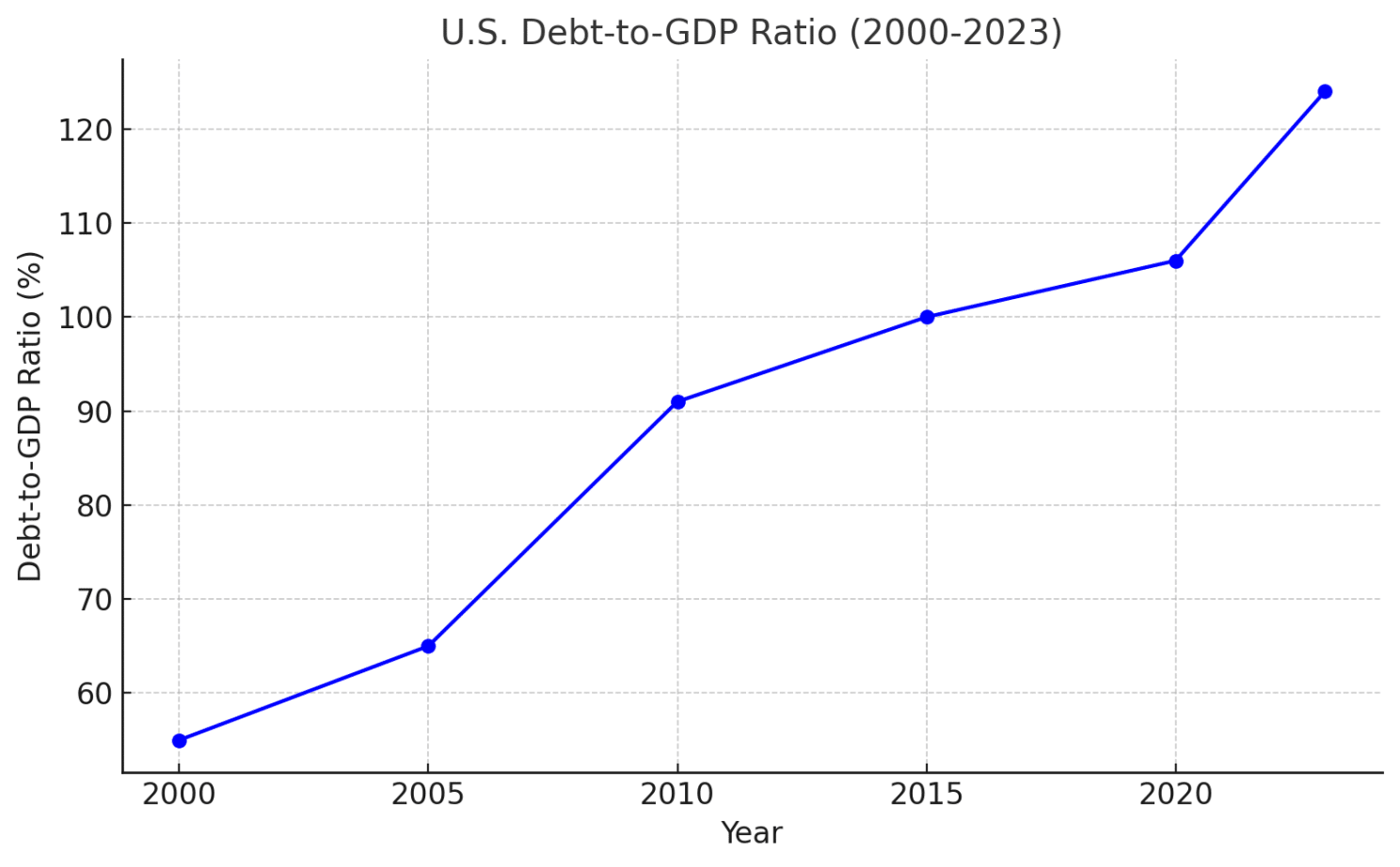

The U.S. debt-to-GDP ratio has been steadily climbing over the past two decades, and as of 2023, it stands at an alarming 124%. This sharp increase means that the U.S. is borrowing at unprecedented levels, creating significant risks for the economy.

U.S. Debt-to-GDP Crisis

As seen in the chart above, the U.S. debt-to-GDP ratio has increased dramatically, leaving policymakers with fewer options to manage fiscal challenges. Such high levels of debt hinder future economic growth, as more resources are diverted toward debt servicing rather than productive investments.

The Cost of Servicing the Debt

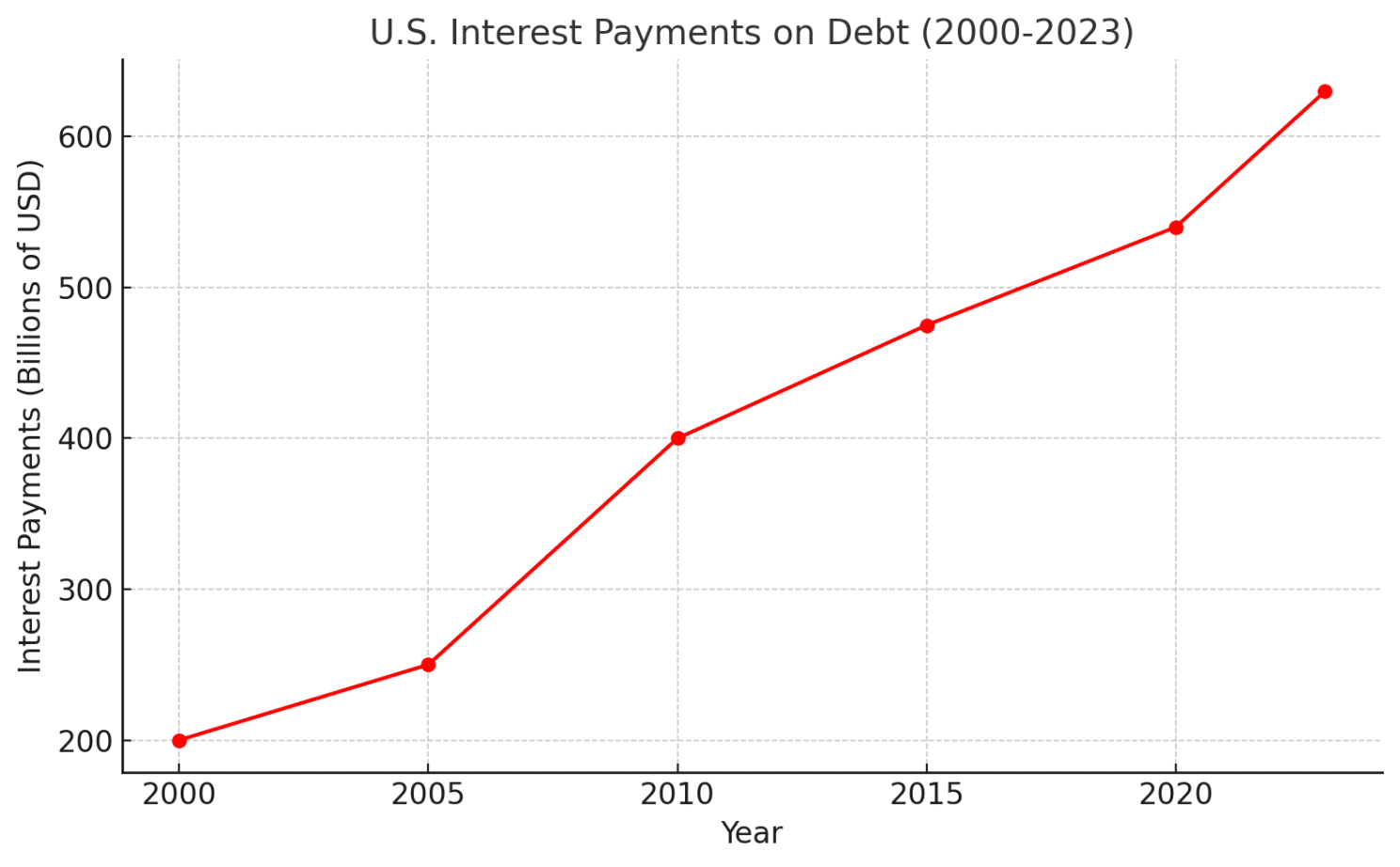

Servicing the national debt is becoming more difficult, particularly as interest rates rise. Interest payments on the debt have already surpassed several major government expenditures, including national defense. This trend is expected to worsen, placing additional strain on the U.S. economy.

US Interest Payments

The chart above illustrates the escalating cost of servicing the debt. With interest payments alone consuming a large portion of federal spending, the risk of a debt spiral is becoming more apparent. As borrowing costs rise, more money is spent on interest payments, leaving fewer resources for other essential functions.

Gold: A Time-Tested Hedge Against Inflation

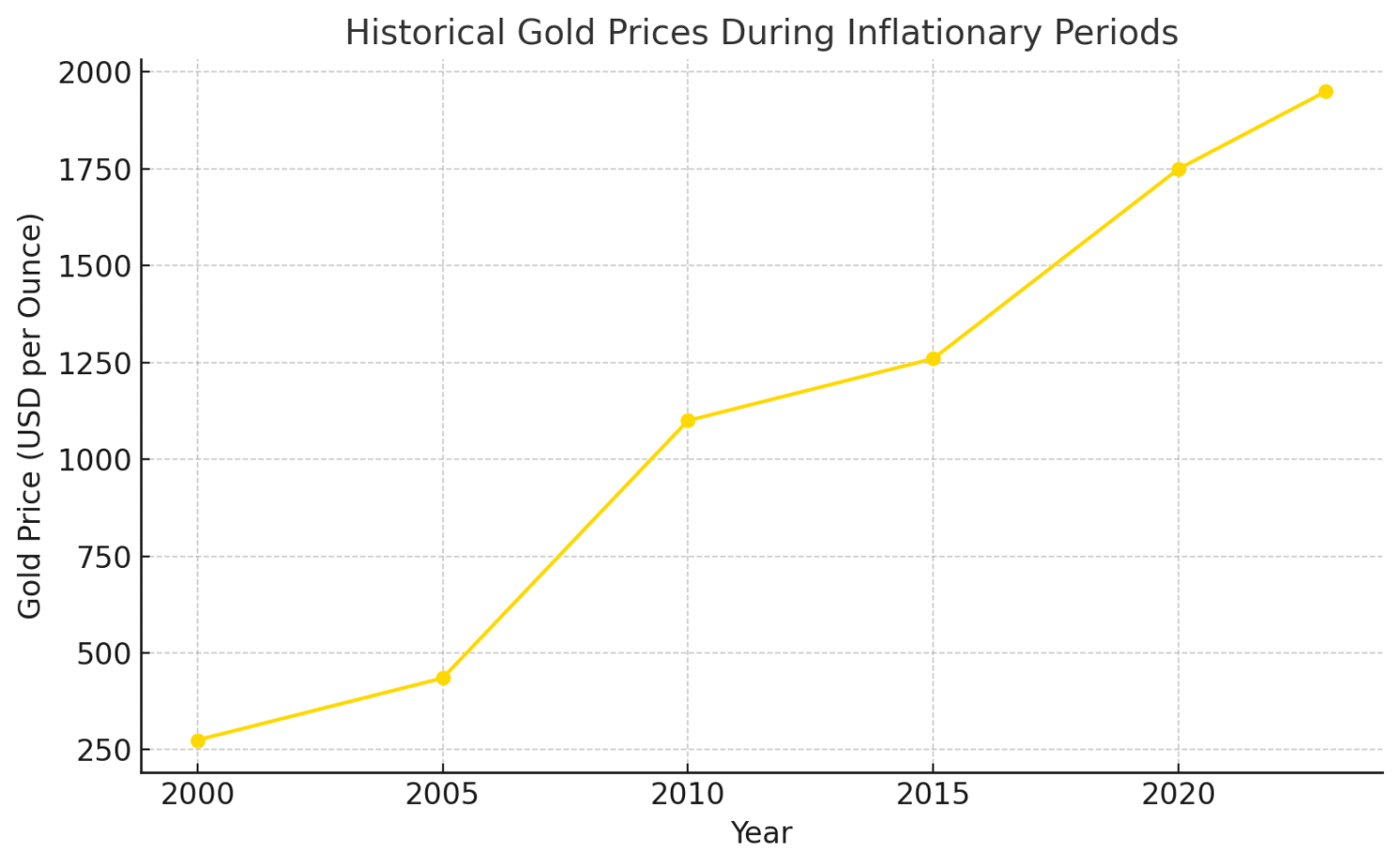

Amidst these economic concerns, gold offers a crucial safeguard. As inflation rises and the dollar’s value declines, the demand for gold typically increases, driving up its price. Historically, gold has acted as a reliable hedge against inflation, preserving wealth when other assets lose value.

Gold Price During Periods of Inflation

The chart above shows how gold prices have responded during periods of inflation. Investors who hold physical gold benefit from an asset that retains its value, regardless of monetary policies or economic fluctuations. As inflation erodes the value of the dollar, gold remains a stable store of wealth.

The Bottom Line

As the U.S. grapples with its debt crisis, the ability to service this debt becomes more tenuous. Inflation appears to be the likely path forward, but it is investors who will feel the pinch through depreciating assets. Gold, however, remains a steadfast protector of wealth and an essential part of any diversified portfolio in times of economic uncertainty. In this environment, physical gold isn’t just an investment—it’s a lifeline.

Let’s connect if you’re interested in learning more about physical gold ownership and how it can play a pivotal role in securing your financial future.

Disclaimer: This information is for educational purposes only and does not constitute financial or investment advice. Investors should seek personalized guidance from a financial advisor or other professionals regarding their individual circumstances before making any investment decisions.