“I Own Gold.”

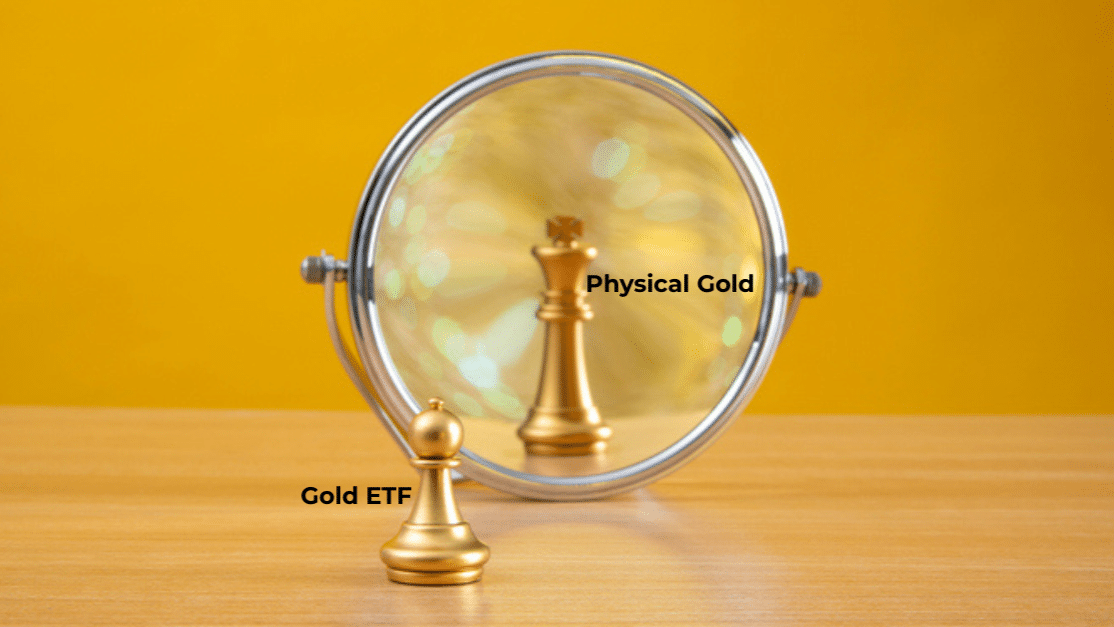

Many investors proudly make this statement—especially during uncertain times. But here’s why gold ETFs aren’t what you think they are:

Do You Actually Own Gold, or Just a Paper Claim?

Owning gold through an ETF or futures contract means you hold a claim on gold, not the metal itself. In a system built on counterparty risk, that assumption could become costly.

Understanding Gold ETFs vs. Physical Gold

1. Gold ETFs: A False Sense of Ownership

Gold ETFs attract investors who want exposure to gold’s price. They seem convenient, but they don’t offer direct ownership. When markets become unstable, that difference becomes critical.

You Own Shares, Not Gold

Buying a gold ETF means purchasing shares in a fund that holds gold—but you don’t own specific bars.

- No direct claim to a specific ounce of gold.

- No ability to withdraw physical gold.

- Dependence on intermediaries for maintaining value.

By contrast, a Strategic Gold Clear Title Account ensures:

- Full allocation—your gold is uniquely identified and owned.

- Secure storage in your name, independent of banks.

- Immediate accessibility—without third-party restrictions.

2. ETF Redemption Limitations

Investors assume ETF shares can be redeemed for physical gold. The reality is different.

Most gold ETFs impose strict conditions:

- Retail investors must settle in cash—no direct gold delivery.

- Only institutional investors with large holdings qualify for redemption.

- Even eligible investors face delays, with gold sourced unpredictably.

With a Strategic Gold Clear Title Account, there are no redemption restrictions—your gold is truly yours.

3. Hidden Risks: Rehypothecation

Few investors realize gold ETFs may engage in rehypothecation, meaning assets are used as collateral for loans or financial transactions.

Simply put:

- ETFs claim to hold gold.

- That gold may be leased, loaned, or otherwise encumbered.

- Multiple investors could have claims on the same bars.

During a financial crisis, ETF holders may discover they are unsecured creditors—while physical gold owners retain full control.

With a Clear Title Account, your gold is:

- Never leased, loaned, or encumbered.

- Stored exclusively under your ownership.

- Completely within your control.

4. Where Is Your Gold Actually Stored?

Even if an ETF holds physical gold, where is it kept?

Most store their gold in bank vaults, meaning:

- Assets are subject to banking regulations and potential freezes.

- Bank failures or government actions could restrict access.

- Investors lack visibility into their gold’s allocation.

Compare this to Private Client Bullion Services:

- Gold is kept in fully audited, segregated storage.

- Stored outside the banking system, eliminating seizure risks.

- Investors know exactly which bars they own.

Why True Gold Ownership Matters Now More Than Ever

We are living in an era of rising debt, persistent inflation, and financial uncertainty. While central banks print money at record rates, they are also accumulating physical gold at an unprecedented pace.

What Does That Tell Us?

- Institutions aren’t investing in gold ETFs—they are taking direct possession.

- Central banks prefer real gold over paper claims.

The trend is clear: those who understand history secure physical gold, not digital proxies.

When financial markets freeze and institutions fail, only those who hold real gold will remain protected.

Gold Is a Safe Haven—But Only If You Truly Own It

Gold ETFs offer convenience, but real wealth preservation requires direct ownership. Financial crises expose the dangers of paper markets.

When the moment of reckoning arrives, will you be left hoping your claim holds—or will you possess the real thing?

If you’re ready to secure your gold ownership, let’s discuss how a Strategic Gold Clear Title Account can help.

This article is for informational purposes only and should not be considered financial advice. Please consult a financial advisor for personalized investment guidance.